GPF Interest Calculation On Above 5 Lakhs For Deduction Of TDS From The Pay And Allowances

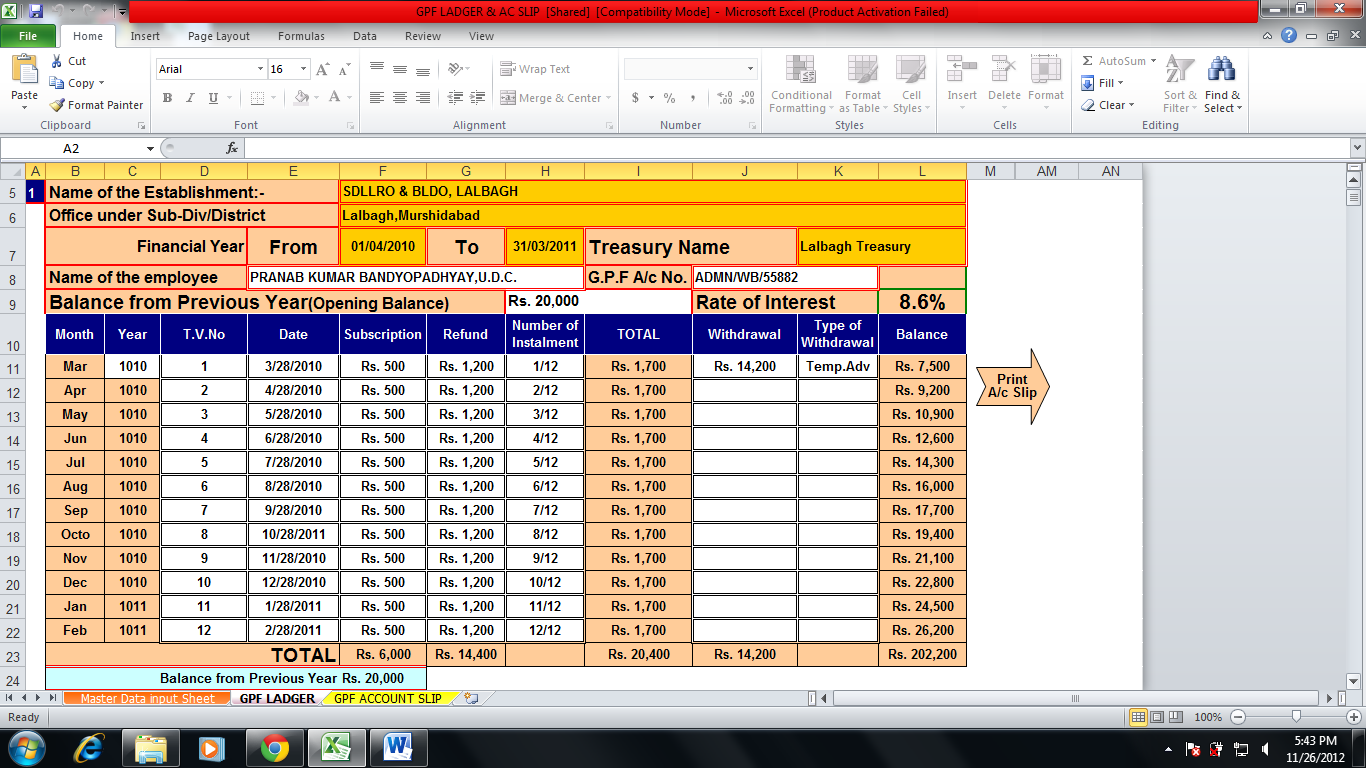

Calculate GPF interest in One sheet Individual ledger, Form X, Broadsheet all in one using Excel .Blog detail in text with picture you can download from he.

GPF Interest rate at 7.1

Subject: Calculation of Income Tax on Interest of GPF- Regarding. Please refer MoF Department of Revenue (CBDT)'s notification No.95/2021/File No. 370142/36/2021-TPL dated 31-08-2021 (Copy enclosed) regarding deduction of Income Tax on interest of GPF subscription over Rs. 5 Lakhs during the financial year 2021-22. 2.

How to Calculate GPF Interest in Excel (with Easy Steps)

Rate of GPF interest calculation formula varies normally on yearly basis. Every year new rates of the GP Fund Interest are issued by the Govt department. GPF Interest = (Rate of Subscription x 6.50 + Opening Balance) x Rate of Interest GPF Interest Calculator Excel Sheet Free Download

GPF Interest Rate from July to September 2020 Central Government Employees News

Gpf Interest Calculator In Excel File Format - XLS Download. SEEYEM2000. 10. 1. Comrads, I have attempted a GPF Calculator in Excel, with which, interest on the amount at credit in your GPF a/c can be calculated with effect from 1964. The same is attached. Hope this would be useful to the fraternity in general. Regards.

GPF INTEREST CALCULATION,FORM X,LEDGER & LOAN PAPERS PREPARATION YouTube

GPF interest Calculation Work Sheet; Month: Monthly Subscription: GPF Advance Recovery: Enter the amount wihdrawn in the appropriate month: Enter the amount drawn as advance in the appropriate month:. GPF interest for this year: GPF Balance (including interest) at the end of the year.

Calculation of Interest on EPF or GPF Tax (Amendment ) Rules, 2021

Interest was then calculated using a formula of (Progressive x Rate of Interest) / (100 x Months), where the result of 1239868 multiplied by 8.7 was divided by the product of 100 and 12. This calculation resulted in an additional Rs. 8,989 being added to the account. The grand total in the account then became Rs. 1,31,178.

General provident fund calculator in excel Taxalertindia

This is the formula to calculate GPF Interest: (Total of monthly interest bearing GPF balance/12)* (interest rate*100) Note this formula for academic interest but never do your GPF interest calculation manually any more as we have provided this easy to use online GPF interest calculation tool.

GPF Interest Rate Table from 1967 to 2023

GPF Interest Calculator 2020-21. GPF Calculator 2023-24. Enter Opening Balance as on 1st April 2023. Month. Monthly Contribution. Interest Rate (%) Withdrawal Amount. Balance.

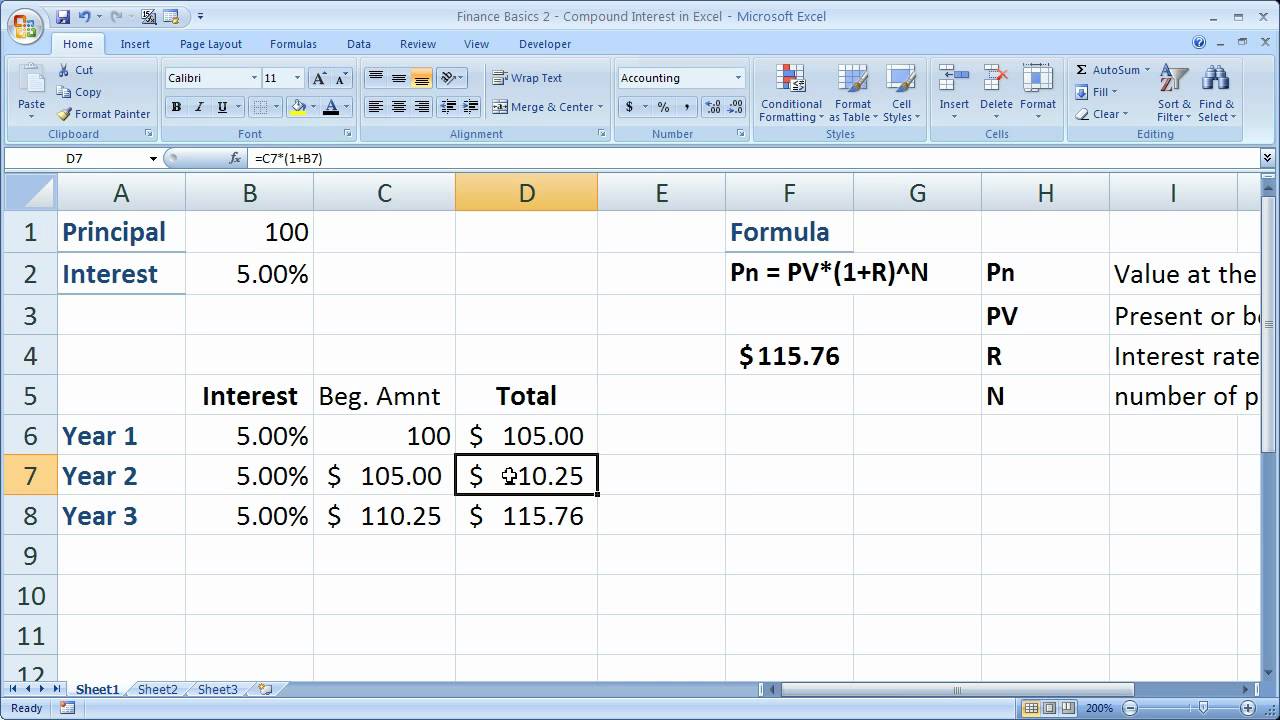

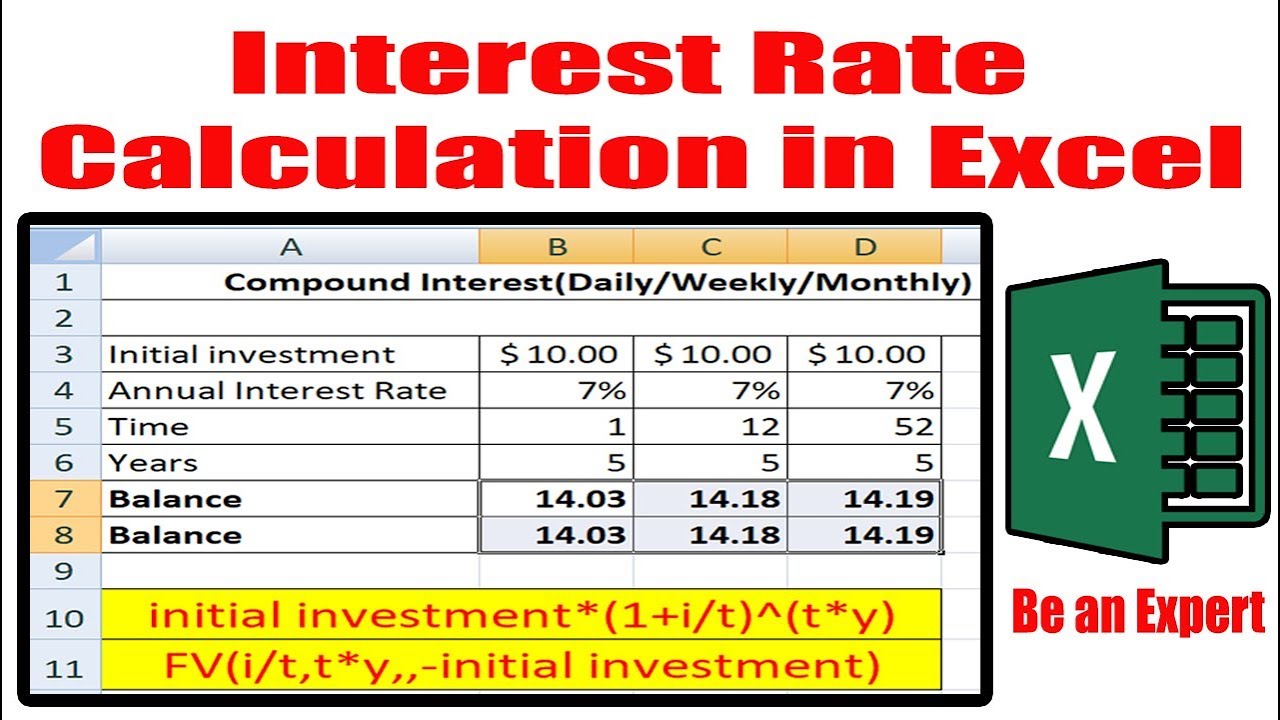

Top Annual Interest Rate Formula Excel Tips Formulas

Step-1: Inserting Primary Data We determine the Provident Fund by using different variables. So we need to insert them first. First, make some columns to store the variables and insert the primary data. We need the amount of Basic Salary, Interest Rate, Basic Increment, Individual and Company Contributions.

GP Fund Interest Rates GPF Interest Rates in PDF Format GPF Calculation Employees Corner Zia

This is the formula to calculate GPF Interest: (Total of monthly interest bearing GPF balance/12)* (interest rate*100) Note this formula for academic interest but never do your GPF interest calculation manually any more as we have provided this easy to use online GPF interest calculation tool. How to use this Tool? Just fill up four fields. 1.

GPF Interest Calculator 202223 Govtempdiary

GPF Interest Calculator GPF Interest Rates GPF Interest Calculator : General Provident Fund Rules, Interest rates, calculator. Calculate the GPF value based on deposit and withdraw amount

[PDF] GPF Interest Rate 202122 PDF Download

As per the 2021 Budget, you are liable to pay income tax on General Provident Fund (GPF) interest above Rs 5 lakh in a financial year. To avoid complications while implementing this rule, CBDT implemented Rule 9 of Income Tax Rules, 1962 in the financial year 2021-2022. Under this rule, you should have two GPF accounts.

GPF Interest Rate January to March 2023 PDF — Central Government Employees Latest News

It must be prepared in M.S. Excel. 30% bonus was remained allowed on interest/profit up to 1999-2000, but later on, discontinued. Opening Balance can be zero.

How to Calculate GP Fund Profit GP Fund Interest Calculation GPF Calculation Employees

How to use this Tool? Just fill up four fields. 1. Opening Balance of GPF at the beginning of the year, 2. Monthly subscription amount, 3. monthly advance recovery if any and 4. Select the Year for which you intend to calculate GPF Interest . Then click "Calculate GPF Interest" Button. That's it! Your GPF work sheet is ready.

Interest Rate Calculation in Excel YouTube

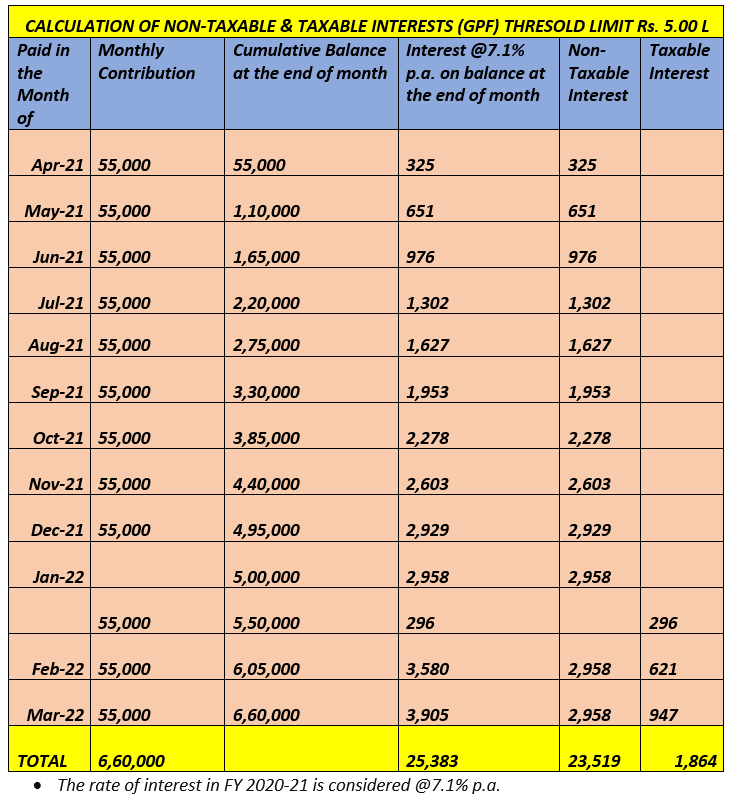

The rate of interest in FY 2020-21 is considered @7.1% p.a. ACCOUNTS TO BE MAINTAINED IN EPF/GPF BY THE CONCERNED DEPARTMENT The accumulated balance in GPF Account of Mr. Aman is considered of Rs. 30.00 Lakhs as on 31/03/2021. The Rate of Interest in GPF Account for FY 2021-22 is considered @7.1% p.a.

Clarification Regarding GPF Interest

FORMAT OF GPF CALCULATION Calculate interest for the year 2019-20 having following details Opening balance as on 01/04/2019 212775 Monthly Subscription 10000. Rate of interest (04/2019 to 06/2019 @8% & 07/2019 to 03/2020 @ 7.9%) 8%,7.9% Month Subscription Refund Arrears Total Deposit Withdrawal Progressive Apr-19 10000 5000 0 15000 0 227775.